[Research] Read the April Crypto & DeFi Report Here

Welcome,

Gas fees for Ethereum have surged due to the return of memecoins, while Bitcoin's BRC-20 tokens have resulted in network congestion, causing approximately 450,000 unconfirmed transactions and prompting exchanges to suspend BTC transactions temporarily.

Let’s explore how the market reacted to these and other news from the crypto space in the past seven days.

The top 10 cryptocurrencies remained unchanged in the past week, but the majority of leading cryptocurrencies experienced a price decrease (XRP -7.52%, DOGE -7.24%), indicating a shift in investor capital. Despite recent drops, Bitcoin and Ethereum have maintained their prices from a week ago and remain dominant in the market.

Ethereum Median Gas Fee Hit 1-Year High Amid Memecoin Resurgence

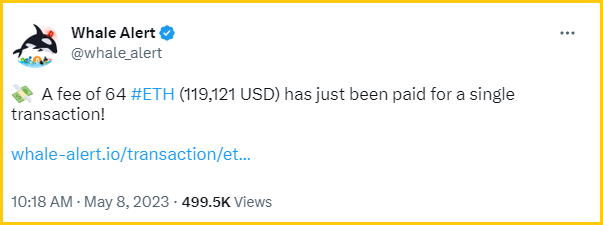

In recent weeks, the median price of Ethereum gas has surged to levels not seen in the past 12 months, causing concern for users and developers who find it increasingly expensive to perform even simple transactions on the network. The high gas fees are due to the increasing demand for processing transactions, as memecoins return to the market after being silent for almost two years.

This surge in demand has caused frustration among users, who are finding it challenging to participate in the Ethereum ecosystem due to the high cost of gas fees. In addition, the resurgence in NFT trading on the Ethereum blockchain has also contributed to the high gas fees.

Ordinal Inscriptions and BRC-20 Tokens Cause Bitcoin Fee Spike

The use of BRC-20 tokens, a new type of asset that uses Ordinal inscriptions to attach data to individual satoshis, is causing a surge in transaction fees on the Bitcoin network. Meme coins, which have seen a rise in popularity in recent months, are beginning to use the BRC-20 standard instead of Ethereum, leading to congestion on the Bitcoin network.

The popularity of BRC-20 tokens has led to a record high in daily minting fees, and the market cap of BRC-20 tokens has reached $920M. Binance has also halted BTC withdrawals twice in 12 hours due to a large volume of pending transactions. Work is already underway for a new standard called BRC-21, allowing tokens on other chains to be minted and redeemed to and from the Bitcoin blockchain.

Stripe Launches Fiat-to-Crypto Onramp With New Hosted Option

Stripe has launched a fiat-to-crypto onramp to make purchasing cryptocurrencies easier for US-based customers. The new offering includes built-in fraud tools and identity verification to support companies in meeting KYC and compliance checks necessary to prevent fraud. The company has also signed agreements to raise over $6.5B at a valuation of $50 B with existing and new investors.

L1 Blockchain Sui Launched Mainnet, Token Rallies

Layer 1 blockchain Sui, valued at $2B, has launched its mainnet to compete with DeFi rivals, including Aptos. Sui’s token currently trades at $1.16, up from its pre-sale price of 3 cents and public sale price of 10 cents, and has a market cap of $610M.

The network currently has $25.31M in TVL, with 80.03% of it allocated to the Cetus DEX. Sui has promised fast transaction speeds, and their current peak of TPS has reached 342, according to their explorer page.

Curve Deploys crvUSD Stablecoin Smart Contract on Ethereum

Curve Finance has launched its stablecoin crvUSD on Ethereum using the Lending-Liquidating Automated Market Maker Algorithm (LLAMMA) design. The smart contract uses an external oracle to ensure that crvUSD pools are composed of two different assets: crvUSD and the asset used to mint the stablecoin.

Top Stablecoin Yield Pools (Single Exposure Filter)

While the average 30d APY of the list dropped slightly, the Credix’s USDC pool has remained strong at 13.07%, followed by Conic Finance’s USDC at 12.73%. Stargate has managed to rank two of their USDT pools (one on the BSC network and one on ETH) in the top 5 for the week.

Top Blue-Chip Coins Yield Pools (Single Exposure + High Confidence Filters)

The blue-chip category has plummeted, with one 3 pools producing a 30d Avg APY above 1% (out of those with at least $30M in TVL). Instadapp’s ETH pool has raised its 30d Avg APY from 8.70% last week to 10.97%.

Top ETH Liquid Staking Derivatives Pools

Average APY continued growing in the ETH LSD list with Stafi’s RETH pool topping the list at 6.29%, followed by Frax’s SFRXETH at 5.79%. Lido has increased its TVL to the STETH pool from $11.44B to $11.9B.

Read our latest articles in One Click.

The recent congestion in the crypto market has caused a lot of FUD, with both Bitcoin and Ethereum facing significant issues. While high gas fees on the Bitcoin network may hurt its long-term viability as a payment system, it is beneficial for its status as digital gold. The higher fees incentivize miners to work more, thereby improving the network’s security.

As for Ethereum, its DeFi system is still in its early stages, and there is a need for significant improvements to ensure effective functioning. However, the high gas fees are currently a drawback for adoption. Due to these issues, there is a demand for upgrades and the development of new L1 and L2 networks to tackle the challenges faced by the industry.

Max Yampolsky,

CEO at One Click Crypto

ir@oneclick.fi

DISCLAIMER:

This is not financial advice. This newsletter is strictly educational and does not provide investment advice, solicit the purchase or sale of assets, or encourage readers to make financial decisions. Please use caution and conduct independent research.

We regularly prepare insightful reports and case studies about crypto trading and the blockchain industry.

.png)

Congrats! You successfully joined One Click Crypto waiting list. Keep an eye on your inbox, you will get updates soon.

In the meantime, join our communities to be extra cool