[UPDATE] 📱 The Mobile Version Of The 1CC DeFi App Is Live

Welcome to this week’s crypto newsletter.

Over the 7 days, several key things took place in the Web3 world.

Now, let’s delve in and see how the market reacted.

During last week’s market correction, the total global Mcap of crypto dropped to $1.18T, with Bitcoin’s price lowering by -7.21% and Ethereum losing -11.92%. The largest losers among the leading crypto assets were Dogecoin and Polygon at -14.58% and -14.38% respectively.

Meme Coins Are Back With $PEPE Surging +416.03% In The Last Week

PEPE is a new meme coin that launched in April 2023, based on the Pepe the Frog meme. It has a circulating supply of 420M tokens and was designed to be the “most memeable memecoin in existence.”

Despite the perceived lack of seriousness around meme coins, investors have the potential to score big with them. PEPE rose to prominence after a high-profile purchase of 5.9T tokens worth around $1.8M. The hype around $PEPE has led to the creation of similar projects currently trending on Crypto Twitter.

Europe’s MiCA Passes World’s First Crypto Law to Protect Users

On 20 April 2023, the European Union authorized and passed the Markets in Cryptoassets Regulation (MiCA), which is the first comprehensive regulatory framework for crypto assets to be passed by a major jurisdiction.

The regulation is expected to come into force in mid to late 2024 and will apply across the EU directly. MiCA covers initial token offerings, stablecoin issuers, licensing of crypto asset service providers, and market conduct. The regulation includes various asset-referenced tokens, electronic money tokens, and utility tokens. Still, it does not extend to cover specific non-fungible tokens, security tokens, and DeFi.

Gary Gensler Refuses To Answer If ETH Is a Security During SEC Hearing

SEC Chair Gary Gensler faced questions from Congress regarding how the SEC regulates the crypto industry. During the 3-hour hearing, he avoided answering whether ETH was security, which has caused confusion in the industry. Gensler believes existing TradFi rules can work in regulating crypto but acknowledges that they do not mesh perfectly with crypto platforms.

He urges the industry to register with the SEC, but some are worried the US could fall behind in crypto innovation due to unclear regulations. Gensler supports a new regulatory framework for stablecoins but wants the SEC/CFTC to crack down on fraud. Rep. Warren Davidson is trying to oust Gensler from the SEC, and Gensler and his staff do not own any crypto, including Bitcoin.

Finally, Gensler said AI is the most transformative tech of our time, not crypto.

Sui Network Announces SUI Tokenomics: No Airdrop Leaves Investors Disappointed

The Sui Network, a DeFi Layer 1 protocol, has announced the basics of its tokenomics to create a flourishing economy with low fees, sustainable building costs, and reliable activity for operators. The economy has three main participants: users, SUI holders, and validators.

SUI tokens can be staked to secure the network, used to pay transaction fees, used as a native asset, and provide voting rights for governance. Sui’s tokenomics consist of Proof-of-Stake, Gas Mechanism, and Sui’s Storage Fund. However, the community has expressed disappointment over the project’s community access plan instead of a SUI token airdrop.

PancakeSwap Leaders Propose Cutting CAKE Token Inflation Target to 3%-5%

The PancakeSwap DEX has proposed a drastic cut in the inflation rate target for its CAKE token from above 20% to 3%-5% to move towards a deflationary model. Lowering the inflation rate could lead to higher token prices based on the rules of supply and demand.

The proposal, known as “version 2.5” tokenomics, will involve slashing the token rewards paid to traders and stakers by over 68% and dropping the CAKE “emissions” on Syrup Pool by 94%. The proposal aims to transform the high-inflation CAKE staking model into a low-inflation model with real yield and utility.

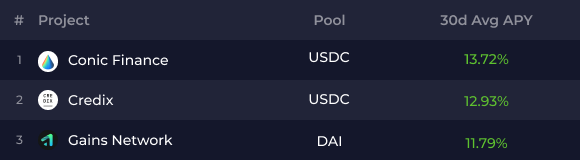

Top Stablecoin Yield Pools (Single Exposure Filter)

This week’s leaders in stablecoin yield remain the same, but their average 30d APY has dropped by ~1.23%. In first place, Conic Finance’s USDC pool currently offers 13.72%, while Credix’s USDC pool has flipped Gains Network’s DAI for the second place with 12.93%.

Top Blue-Chip Coins Yield Pools (Single Exposure + High Confidence Filters)

Lido’s STSOL pool remains first in the blue-chips category with 6.80% 30d Avg APY, while Birfrost’s VETH pool (an LSD from the next class) takes over second place at 6.04%.

Top ETH Liquid Staking Derivatives Pools

Frax’s SFRXETH pool dropped to third place with an average 30d APY of 5.58%, while Stafi’s RETH pool climbed first at 6.46%, followed by Bifrost’s VETH at 6.04%.

The DeFi world continues to evolve rapidly, with its fair share of challenges and surprises. As we witness new projects emerge, and old ones face difficulties, it’s clear that the DeFi space is constantly optimizing. CeDeFi platforms, on the flip side, are searching for a safe haven in crypto-friendly countries.

The recent rise of meme coins also highlights the unpredictable nature of the crypto market. As we move forward, it will be interesting to see how the DeFi space continues to evolve and how it will impact the wider financial landscape. The recent European regulations might be a step in the right direction, while the “wild west” keeps causing uncertainty.

— -

Discover how One Click Crypto simplifies DeFi with yield discovery, portfolio management, dynamic rebalancing, cross-chain routing, customized portfolios, and unique hosted strategies in our latest Medium article.

Max Yampolsky,

CEO at One Click Crypto

ir@oneclick.fi

DISCLAIMER:

This is not financial advice. This newsletter is strictly educational and does not provide investment advice, solicit the purchase or sale of assets, or encourage readers to make financial decisions. Please use caution and conduct independent research.

We regularly prepare insightful reports and case studies about crypto trading and the blockchain industry.

.png)

Congrats! You successfully joined One Click Crypto waiting list. Keep an eye on your inbox, you will get updates soon.

In the meantime, join our communities to be extra cool