Welcome,

DefiLlama, a data aggregator, has announced the release of a new risk assessment tool. The feature provides on-chain liquidity information for any token, including the amount of tokens that would need to be sold to drive the price down by a certain percentage.

The tool is currently in beta, and interested parties can contact Defillama for access, while the public launch is expected to be in the upcoming weeks. Risk analysis tools for both DeFi and CeFi are currently gaining popularity, so we expect more software like this to go live.

Bitcoin (BTC) is trading at $16,820 or +2.33% from 7 days ago, while Ethereum (ETH) gained +3.95%. The best-performing asset in the top 10 list is XRP with +7.64%, while BNB is up by a modest +0.71%.

1inch Network Introduces Major DeFi Upgrade with Zero Network Fees

The 1inch Network has released Fusion, a major upgrade to its 1inch Swap Engine aimed at improving the profitability and security of swaps on the decentralized finance platform.

Fusion mode enables users to exchange tokens on various decentralized exchanges without paying network fees while also offering increased security and updated staking contracts and tokenomics, according to 1inch’s announcement.

The 1inch Swap Engine powers Fusion mode, connecting users with almost limitless liquidity through professional market makers using a decentralized order matching approach based on the Dutch auction model. Users can choose between three options: Fast, Fair, and Auction, depending on their desired rate and execution time.

US Bitcoin Mining Company Core Scientific Files for Bankruptcy

US-based bitcoin miner, Core Scientific, has filed for Chapter 11 bankruptcy protection. Despite the filing, the company plans to continue operating and producing bitcoin while negotiating a restructuring deal with its creditors.

The Nasdaq-listed company is one of several whose stock has been hit by falling token prices and rising energy costs. Core Scientific’s market value reached almost $3Bn in April but has since fallen to less than $100M.

Bitcoin’s Hashrate Recovers From 40% Plunge

Cold temperatures in the US caused a drop in Bitcoin’s hashrate, leading to voluntary shutdowns by Texas BTC miners. The network’s hashrate fell to 170.61 EH/s on December 25 but recovered to 244.22 EH/s on December 25, according to CoinWarz data.

Read our latest research article in one click.

Aggregated return of One Click Crypto vs. BTC and ETH

Last week, Bitcoin gained +0.55%, while Ethereum rallied +3.02%. The average returns of all 1CC trading strategies produced -0.29% for the full seven days.

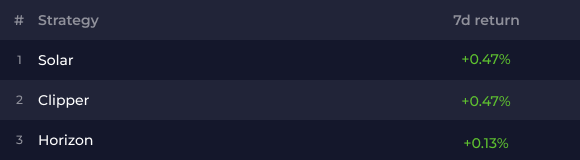

Top trading strategy

Last week, One Click’s top-performing crypto trading strategies were Solar and Clipper at +0.47% average ROI, followed by Horizon at +0.13%.

Top-performing market pairs

The Performer v1 trading AI did exceptionally last week against Litecoin. In Both LTC: USDT and LTC: EUR, the trading bot produced a +10.17% ROI.

The crypto industry faced many challenges in 2022, including global macro events and black swans that caused crypto dominos to fall. Despite everything, the community remained resilient and continued making progress in DeFi and Web3 technology.

The Ethereum Merge was the most significant tech update in crypto since the early days of Bitcoin, and now other protocols are following suit by further improving their networks.

Got a project that you are currently lurking on? Let’s discuss it on Discord.

Max Yampolsky,

CEO at One Click Crypto

ir@oneclick.fi

DISCLAIMER:

This is not financial advice. This newsletter is strictly educational and does not provide investment advice, solicit the purchase or sale of any assets, or encourage readers to make financial decisions. Please use caution and conduct independent research.

We regularly prepare insightful reports and case studies about crypto trading and the blockchain industry.

.png)

Congrats! You successfully joined One Click Crypto waiting list. Keep an eye on your inbox, you will get updates soon.

In the meantime, join our communities to be extra cool